Nearly 5 Years of Day Trading: The Honest Truth About Realistic Expectations

If I fell into a hole and looked up, there would be a tiny white dot of light. That’s how deep of a hole I dug myself into after nearly 5 years of day trading. You might think I’m exaggerating, but I’m actually not. Let me take you through the story of how I got there and what I’m doing to get out.

I want to take you back to when I first started this journey! I was so confident in my abilities that I was estimating a 60% return in a matter of months. You can read about those “cocky” expectations in my first month of trading stocks.

It was peek delusion and overconfidence!

If you’re thinking day trading is easy money, or that you’ll be different from the 90% who fail, this post is for you. Because what happened in years 2 through 5 (well coming up on 5) of my trading journey makes my first year look like a good year.

Disclaimer

Since it’s been a few years, I might mix up the timeline of events or not get them exactly correct. This is all to the best of my knowledge and what I remember over the years.

If you haven’t read my previous posts on my journey into trading, I documented my struggles at 3 months, 6 months, and at 1 year of trading.

The pattern was clear: I was really good at losing money.

Well, technically at holding losers instead of cutting them and not using stop losses.

But surely things would get better with more experience, right?

Spoiler alert: They didn’t.

Mentor #1: Ryan’s “Easy” Moving Average Strategy

Before diving into years 2-5, let me quickly recap the strategy that got me started (and kept me spinning my wheels for almost a year).

I had learned about a guy named Ryan, who trades options, from a guy named Ryan who was in e-commerce (I know… quite poetic). Anyways, he claimed to make thousands per day with an “easy” trading strategy that took 1 hour a day. I was instantly curious due to my interest in investing. Though in hindsight, these gurus, furus and financial influencers all seem to proclaim this to some extent.

The strategy was adding 2 indicators to a chart. The 14-day and 21-day moving averages (MA). The idea was to find a stock where the price had broken above both lines, then was being supported by the 14-day MA, and the 14-day line had to be above the 21-day line. This would trigger a long trade and one should stay in it until the 14-day line goes below the 21-day line, or the gap between the lines start shrinking, or a bad candle prints (e.g. an inverted “T” shape).

I believe I used this strategy on/off for around a year and had flatline to slightly declining results with it. I won some trades where I made really nice gains, like a +40% return. But I also had some losers that I held onto, didn’t cut, and they turned into large double-digit negative returns. Ultimately these losses won out and brought me down by the end of the year.

When I look back now at what my problem was? I didn’t know where to get out. I didn’t know what invalidated my trade. I didn’t like stop losses and often was trading on hope and faith. Basically that the stock would turn around and I’d be right. Because… we all want to be right, right?

Little did I know that this would become a very recurring theme for me throughout my entire trading journey thus far.

The Scammer Phase: When Desperation Meets Fraud

Around the 5-month mark into my trading journey, I came across what I didn’t know at the time was a scammer in the trading space. I stuck with his approach for a little over a year before quitting on the mentor’s strategy.

I found out about him from a friend who had recommended that I try this mentor’s strategy, because his friend had made $25K+ with it. That recommendation was enough for me to buy his course and dive in.

Ps: If you find a man whose name starts with a “D” and his course has the word “fish” in it… run!

This guy offered “live 1-on-1 trade mentoring”, but there was no live trading at all. It was just looking at old charts and him saying, “Oh… you should enter here and exit there.” An absolute joke and fraudster. Unfortunately, I wasted too much time with him and on his mediocre strategy at best.

His strategy was deceptively simple:

- Go all in on a trade

- Aim for 1% gain per day

- Base entries on 2 indicators: RSI and MACD

- Buy when RSI is oversold and MACD is starting to curve up

For the first 3 months using this strategy, I was hovering around breakeven, and I really believed it would work out. But I felt something knowledge was missing, so I wrote to the mentor. First, he upsold me on his higher-priced course, which I bought. Then the more I learned from his advanced material, the worse my results got.

Market conditions seemed to worsen with his strategy. Many setups that looked great and met all the criteria… randomly failed. And failed harshly. I started losing more and more, and going deeper into the red.

What happened was this: setups that should have been “guaranteed” 1% winners were turning into 2%, 5%, or even bigger losses. The bigger losses were my fault though as I had refused to cut them quickly. While the strategy seemed to work somewhat in trending markets, but not at all in other conditions. Further, these were lagging indicators (RSI and MACD), so you were essentially trading blind.

Before you knock me, there was a discord that was setup for the community and a lot of people were complaining that they couldn’t make the strategy work. Most were in the red. Some years later I checked in on the community and most people had left, moved on or were still struggling to make it work.

After about a year of this roller coaster, I had enough. I started learning from other traders on YouTube about the downsides to indicators like the RSI and MACD, and I very much agreed with them. You really had no idea where price was going to bottom, nor where it was going to go up to. You were just trying to catch a ride on momentum, but often times it was short-lived.

It was around this point that I was done with hindsight experts who posted screenshots after the fact showing how much money they made. As all of that can be faked and I didn’t want to experience another person like that again. I wanted someone who traded live, in real-time.

The Educational Detour: Mark Minervini

Around the 9-month mark in my day trading journey, I decided I needed to keep learning more. I had heard of Mark Minervini and bought his book “Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market.”

It was a great book! Much more retail-focused than Ray Dalio’s institutional perspective that I’d read earlier. Minervini provided solid insights into his Volatility Contraction Pattern (VCP) approach. I spent time going through my list of stocks, sorting and classifying them into the 4 stages. Then seeing which ones had bases to see whether the VCP was forming or not.

But here’s where I made a costly mistake that has defined my entire trading career: I was too eager to apply what I learned right away. Instead of demo trading or forward testing this new strategy, I jumped fully into it because I wanted to try something different.

Let’s just say that was an expensive lesson. I ended up being totally wrong several times. Those losses forced me to stop trading Mark Minervini’s VCP approach entirely.

Yes, it was very short lived. Yes, it left a bad taste in my mouth due to my own stupidity. But I also wasn’t fully happy with the strategy because it only traded in one direction (long), and I wanted to trade both directions. You had to wait a long time for setups to form. So this required a lot of work tracking hundreds of stocks and waiting for the VCP to form.

I wanted a trading system that was:

- Better

- Where I didn’t have to constantly scan hundreds of stocks for setups

- Where I could trade in both directions

- Something that I could trade more frequently

I decided to keep searching to see if I could find something better.

The Mentor Merry-Go-Round

Sean: The Entertainer, Not the Trader

My next mentor was 100% retail logic focused, funny, genuine and very likeable. I bought membership access to his site. Then I had gone through most of his educational videos and watched many hours of his livestreams. He introduced me to index futures, and at my 2-year trading journey mark, I switched to trading ES futures. To do this, I also had to switch to a margin account so I could finally trade in both directions.

Thankfully I didn’t put that much money into the account, since I wasn’t exactly doing well up to this point.

This mentor taught me about support and resistance, bull and bear flags, rising triangles, falling wedges, head and shoulders, trendlines and all the classic retail patterns. He also talked about the 50-day, 100-day, and 150-day moving averages, which can act as support or resistance. Now, I did have some basic knowledge of this already from a long time ago, but some stuff was new and it was a good refresher.

One thing that initially attracted me to him was his small account challenge. I was interested in following along and learning how he trades live.

I quickly realized in his livestreams that trading options is different. His trades were very quick! Sometimes less than 10 seconds. Since I wasn’t able to trade options myself, I couldn’t really apply what he was showing because I needed bigger point moves for it to make sense. These micro scalps weren’t doing it for me.

As time went on, I realized he was an entertainer first and not that good of a trader. People watched him because of his personality and humour, not because of his trading skills. He was making a killing from his membership fees, yet he wasn’t able to grow his small account challenge. It finished in the red.

A few months later, I knew he wasn’t the right mentor for me and I didn’t like his trading strategy. So I moved onward and kept searching.

The Marketing Guru: All Flash, No Substance

I came across my next mentor on YouTube. He was sharing a lot of free content, helpful reviews, was really young, and had his lambo. I didn’t necessarily like the flashy lifestyle and money marketing he used, but his approach to trading seemed no-nonsense. He claimed massive winning streaks (like 3+ months of green days). He even logged into his account live and showed $600K+ in trading profits for the year.

I thought… okay, maybe this is my mentor.

So I switched to him and paid for his Discord access. However, I very quickly realized the marketing hype did not live up to the reality once inside. It was overcrowded, with lagging (and disappointing) live streams and crashes, sometimes audio only streams and the education section was pretty weak. They were even illegally sharing educational material. How sad. Especially for how much money the guy makes. My respect for him dropped significantly.

I also followed some of the top traders in his Discord and watched their livestreams on Instagram or YouTube. Sometimes the content was okay, but the explanations for why they entered trades were too rushed. Often you’d join and they were already mid-trade with no context.

I had joined expecting to learn more about the strategy, when to get in, how to get in, where to set stop loss and take profit, and the reasoning behind each decision. It was rather disappointing instead. They never mentioned specifics, just vague remarks, and then suddenly they’re in trades, up $1-3K, and already closing positions.

The pre-market analysis wasn’t worth the price either. I didn’t feel like I was learning how to trade independently or improving my own skills. It was impossible to start conversations in the Discord chat because it moved so fast with too much noise.

I canceled my membership after just one month. I had lost respect for this marketing guru because he relied too much on his best community traders and didn’t seem to have his own consistent ideas. Sometimes it seemed like he was just copying their trades.

But sometimes you learn one piece of knowledge, and that’s all that was meant to be. And that’s exactly what happened.

Somehow I luckily caught someone posting about how their trading really improved when they started following ICT (who is a bit controversial in the trading space), but they mentioned he was doing a free mentorship on YouTube. Naturally, I clicked the link and watched my first 2022 ICT mentorship video.

The ICT Era

After watching my first ICT video, I remember thinking to myself:

“This is it! This is what I’ve been searching for. It ticks all of my boxes.”

I didn’t need to search anymore. I was going to stick to this strategy until I made it work or I was done with trading.

I didn’t know anything about the man (Michael Huddleston, AKA “Ghost in the Machine”), but something captured me about him, his concepts, and approach. It just made sense.

Year 1 with ICT: Getting Humbled

I was already 2+ years into my trading journey, so I had already developed some trading habits. Some were good, some bad. His approach was different to anything I had learned about before, so it became an even bigger challenge to change to his way of trading.

At the time, all I knew was that a new mentorship was going to start soon (2023 ICT mentorship), and I tried to get through as much of the 2022 mentorship content as I could before it began.

I’m not going to lie, I had to pretty much unlearn a lot of things I knew and was already doing. One particular issue was around getting rid of trading indicators and keeping my charts clean. This took quite some time because I had relied on RSI and MACD for so long. Plus, I had to throw out all the “retail logic” (as he called it) and learn his terms, concepts, and ideas.

I had to go through a paradigm shift.

I feel it took me much longer to adapt because my mind already had preconceived notions, and some things he said I didn’t take seriously. Totally my fault.

I was again too eager to get started applying what I had learned, because I didn’t see myself as a beginner. I felt I didn’t need to do beginner steps, the ideas were simple enough and (like before) I paid the price with losses. My inexperience was clearly showing with this new strategy, and I was quickly humbled. Just like when I had tried Mark Minervini’s approach.

But I kept learning, watching his old videos, consuming the live mentorship content, and eventually started paying attention to his tweets and Twitter Spaces. Those were something else. Hours long, filled with amazing nuggets of information, but also really random, negative rants about so many different things. He definitely knew how to capture an audience’s attention.

As I was learning from him and trying to rewire my brain to think differently about the market, I also kept trading on the side. I thought because I already had experience, I could skip parts of his advice and learn on the go from live trading instead.

That’s where I made my biggest mistake:

He had preached a specific process:

- Educate yourself. Go through his lessons & mentorship

- Backtest and create a trading journal of hundreds of marked up trades

- Then move on to forwarding test. Watching the tape as he would say.

- Then demo trade

- The when it is so boring and repetitive for you, move on to live trading.

Unfortunately for me, my ego was too big and I didn’t listen. I skipped too many steps because I thought since I already had market experience, I didn’t need to go back to the very beginning.

Truthfully, I was also addicted to trading and couldn’t stop myself long enough to follow the proper process anyways.

I kept following ICT throughout the entire year until I was 3 years, 1 month into my trading journey. And I had made no actual progress. My account had a few major drops from bad trades where I didn’t have stop losses, and outside of that, it was just a slow and steady decline.

Eventually, my margin account got to a point where I could only buy the minimum amount of index futures contracts and I had essentially 1 trade left.

One trade.

If I lost, my account would have been blown. If I won, I would survive.

The pressure was on. I didn’t want to blow a real account. I focused, needed to be smart, very conservative, and very quick to take breakeven trades. Somehow I survived: win, breakeven, breakeven, loss, win. Finally, I started getting some upward traction and my account began growing again.

I had some tough days throughout that year, but what really helped was when I started listening to ICT’s Twitter Spaces and his psychological lessons. Many were spot-on, right on time, exactly what I needed to hear, and were extremely valuable. They helped tremendously because I was struggling with the mental and emotional side of trading.

Second year of ICT: The Repetitive Mistake

By my second year with ICT, I had one full mentorship under my belt and felt more comfortable with his concepts and trading without indicators. However, I still felt gaps in my knowledge and missing skills.

I went through his entire Core Mentorship (every single video) to fill in those gaps. It took me a while since I took notes and looked at charts for examples, trying to absorb as much as I could.

It was also around this time that I lost some respect for ICT due to some of his lies. He said he was going to leave Twitter forever after 2023 (he didn’t). He said it was his last mentorship (it wasn’t. He made new ones in 2024 and 2025). He said he was going to win the Robbins Cup and set a new record, placing just below his mentor Larry Williams’ record. He never even got on the leaderboard.

I didn’t like these broken promises and lies after all his smack talking. I made the decision to distance myself from actively following him and learning new ICT concepts. At some point, you have to realize you’ve learned enough, and it’s time to focus on making what you know work. Learning more becomes counterproductive.

Instead, I started following some of ICT’s successful students on X. I followed other traders who were showing receipts that they could trade live. When some ICT traders started livestreaming, I immediately started watching them to see how they reacted, formed setups, behaved during trades, took losses, and managed their emotions.

It was very beneficial to see their calm energy, sticking to their plans and trading models. When losses were taken, it was no big deal.

But how did my trading go during this period?

I kept trading much the same way as the previous year. No real impact or growth and this would put me just past the 4 year mark on my trading journey. I had some times where my account was gaining nicely, but 3-4 times per year I would take some big losses that unwound all my progress and sometimes even more.

I kept repeating the same mistake over and over. Holding onto bad trades instead of cutting them early. Sometimes removing stop losses when trades went against me, hoping they’d turn around. They never did.

It was a year I did finish in the green, but it was very ugly. My trading was ugly. I had too many big losses. I could have finished the year really well, but instead, I messed up and took some big losses throughout and also at the end of the year. I wasn’t happy or satisfied with my trading.

In my Third year of ICT: Rock Bottom Realization

I came into my fourth year of trading knowing I needed to get better and had to stop making the same mistakes repeatedly if I was ever going to succeed.

I initially started the year with a bunch of losses. I clawed my way out, got into the green, and was making progress. Then I did my favorite thing: I had another massive loss and gave back most of my gains. I kept trading, went full tilt, and next thing I knew, I was deep in the red for the year. This was only four months into the trading year.

I had enough.

I didn’t trust myself or whatever I was trading with stop loss placement, because I hadn’t done proper backtesting. I kept listening to successful traders talking about following the process and not skipping steps. I was getting tired of losing and making the same mistakes over and over.

After some deep introspection, I came to several realizations:

-

A lot of my big losses came because I refused to be wrong or take a small loss. I’d lower or remove my stop loss and get annihilated.

-

I knew the concepts and had everything I needed to succeed, but wasn’t getting results. I kept hearing ICT’s voice in my mind: “You just want to push buttons and see what happens.” That felt exactly like what I was doing.

-

I wasn’t patiently waiting for proper setups. I would quickly “see” something in the chart and jump in. I was addicted to trading (pressing buttons) and had issues with patience.

-

I couldn’t tell you the stats about my trading model. I was trading too much on gut feeling versus waiting for mechanical setups to form. I felt emotional during trades, which was directly related to this lack of a defined process.

-

I felt that because I skipped proper steps (like backtesting and properly defining a model), I was shooting myself in the foot. I was at a disadvantage. I always assumed I’d figure it out on the go, but it just wasn’t happening.

-

I lacked the confidence to be okay with taking multiple losses. That ties in very well with the previous 2 points.

The Emotional Trading Trap

During this period of repeated failures, I was also struggling with something that made everything worse: trading under poor mental states and heightened emotional conditions.

You know the feeling. You take a loss, and instead of stepping away, you want to get right back in and “make it back”. Your previous loss (or losses) still linger in your mind, clouding your judgment. Or maybe you had a fight with your partner, or personal life stress is eating at you. But you sit down at your trading desk anyway, convinced if you just win… you’ll feel better.

But usually it just makes it worse.

If I think back, I was revenge trading, FOMO trading, and making terrible trades in heightened emotional states that consistently lost me money extremely quickly. At one point I recognized this was a major problem of mine, so I created a simple emotional checklist chart in Keynote. It was basic, but it gave me a way to gauge my emotional level before starting a trading session.

Am I calm? Am I anxious? Am I furious about a previous loss or something in my personal life?

I have to admit, I didn’t use it much initially. But since, I’ve used it twice this year when my emotions were quite high and I wanted to trade. The chart told me to stay away from trading and I have no doubt that it saved my account from taking some massive losses.

This experience proved how valuable a simple emotion check could be, so I decided to turn that little chart into an interactive web tool that anyone can use. You can try out this pre-trading emotions checker tool.

It’s designed to be a simple, but effective circuit breaker between your emotions and your trading capital. Because building a system to protect yourself from your worst impulses is one of the most profitable trades you can ever make.

The Backtesting Epiphany

Returning to trading steps or processes that I skipped over in my trading journey, the topic of ‘backtesting’ kept coming up in my mind. I had long been avoiding it. I had done a little bit of backtesting, but that was not proper backtesting and it was not enough. Skipping the process wasn’t acceptable anymore. I now see that it only set me back years and prevented me from reaching the success that I was chasing.

I kept remembering ICT’s famous line: “Don’t take my word for it, go and backtest it.”

His recommended process was clear: education → come up with or learn a strategy → backtest it → forward test → demo trade → then live trade.

I came to this realization.

All of this could have been avoided if I had properly developed my trading strategy and model in my first year of ICT.

Knowing how often setups occur, what the win rate is, what the average winner and loser looks like, and the overall profitability. This knowledge would have calmed my mind and helped me stick to the process. As long as my live trading results matched my backtested results, I�’d know everything was on track.

Basically, I needed to really know and define my model so I could avoid making emotional decisions when trades didn’t behave exactly as I wanted them to.

At the beginning of this realization period, I started researching backtesting software extensively. I looked at both paid and free options, but never really found what I needed.

The paid options were nice, but none did exactly what I wanted. They were more focused on “go back in time and trade” versus actual strategy development and improvement.

A couple options had elements of strategy development, but they were focused on algorithmic trading, which wasn’t what I was looking for. The free options were even worse. Some didn’t even work, were backend-only with no support, or were well-supported but in programming languages I didn’t want to use. They were too focused on optimization for 100% mechanical strategies, and the frontends were terrible.

I’m a visual person and needed something visual and intuitive.

So the more I thought about backtesting, and given my background as a developer and interest in entrepreneurship, I thought: why don’t I build my own tool?

Make it exactly what I’d want to use and buy. I sat with the idea for a few months, because I had some commitments in the first half of the year, I wasn’t able to really start working on until the middle of 2025.

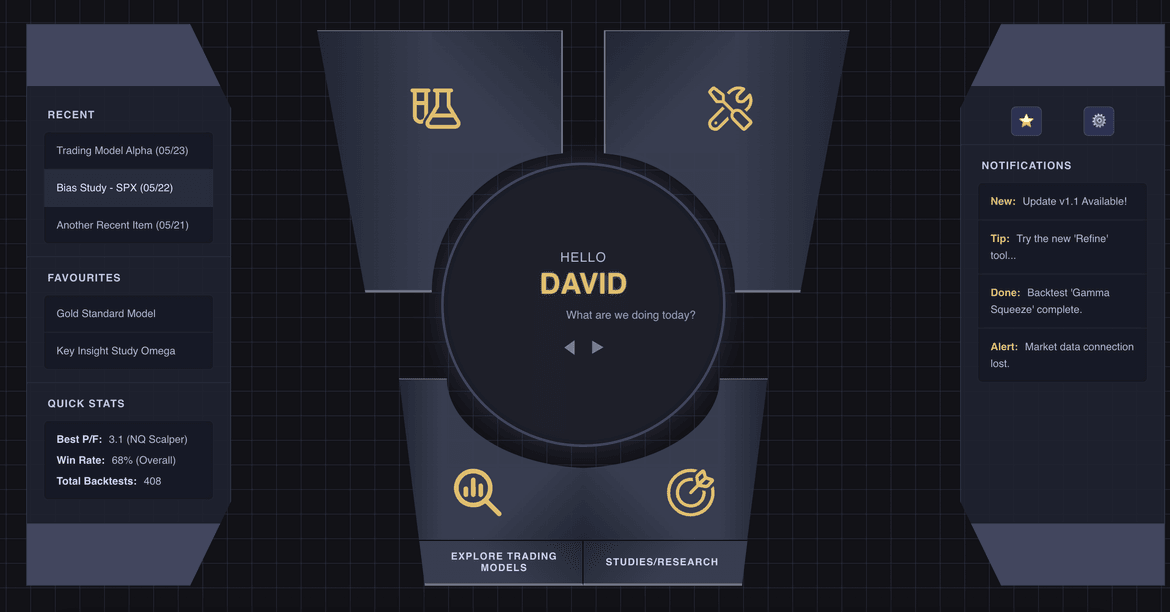

The Solution: BacktestingLab

My trading has taken a bit of a backseat to this project. One great benefit is I no longer feel addicted to needing to trade every day. I aim to trade once a week and the rest is spent on developing this desktop software. This has resulted in me steadily building my trading account back up by trading as little as possible.

The project is a real challenge. It is going to take a long time to build out the software completely (even with using AI), but I know it’s going to help me in the long run.

My plan is to continue this approach: build my software and trade minimally. At some point I’ll develop my own bias model and then trading models with my software.

Anyways, let me briefly explain what the software is that I’m building.

It is called, BacktestingLab and it’s a desktop application built on a simple premise. Professional traders need professional tools. It’s the tool I need right now to help me develop a profitable trading strategy.

Some key features include:

- Privacy-First: Your data and strategies never leave your PC. You own them. Period.

- Hybrid Workflow: Marries automated analysis with the manual, discretionary review a real trader needs

- Slick UI/UX: A clean, professional, and intuitive design that makes rigorous testing feel like a creative process, not a chore

- Build Your Playbook: A systematic process to turn your best ideas into a library of statistically-proven trading or bias models

It’s still under development, but I share project updates on my X account for anyone interested in following the journey.

The Lessons & Realistic Expectations

Near the end of 2025, I’ll be at the 5 year mark in my day trading journey and here’s what I’ve learned about realistic expectations:

The Hard Truths:

- Most retail traders fail, and it’s not because they’re stupid. Maybe it’s because they’re too smart so they skip over the boring but essential parts

- Your ego is your worst enemy, especially when you think you’re “better than” following a proven process

- Mentors aren’t magic solutions and vary widely. Following proper process and discipline are everything

- If someone tells you trading is “easy money,” run

- The market will humble you repeatedly until you respect it

- Listen to the advice of good traders

What Actually Matters:

- Education first, always

- Backtesting isn’t optional (it’s essential for understanding your edge)

- Demo trading isn’t “fake” practice (it’s where you prove that your strategy works)

- Emotional control is a skill that must be developed, not ignored

- Position sizing and risk management matter more than being “right”

For Anyone Starting Their Journey: Don’t make my mistakes. Don’t skip steps because you think you’re special or different. I took the long way in learning this lesson.

The traders who succeed aren’t necessarily smarter or more talented, but they’re the ones who follow the process, do the boring work, and treat trading like a business rather than gambling.

If you’re looking for realistic expectations about day trading: expect it to be harder than you think, take longer than you want, and cost more than you plan. But if you’re willing to do the work properly (education, backtesting, demo trading and proper risk management) you might join that small percentage of people who actually make it.

Where I Am Now

Do I wish I had started building BacktestingLab a year ago? Absolutely. Do I wish I had listened to ICT’s process from day one? Without question.

But regret is just another emotion that can derail your trading if you let it. Instead, I’m focused on building the tool that will help me and hopefully other discretionary traders too. The goal is to develop a profitable trading model and trade with statistical confidence rather than on hope.

While I’m still deep in that hole from when I first started, I now have a ladder to get out. It’s a systematic approach to strategy development that I wish was my first step into trading.

If you want to follow my journey building BacktestingLab or get updates on my trading/bias model development, you can find me on X @davidpnowak.

On a final note, remember this: Stop trading on hope. Start building a statistical edge.