Introducing the One Tool That can Prevent me From Making Dumb, Emotional Trades

Can one tool, a simple emotional level checker, change your day trading results? If you struggle with trading off of emotions at times, you’ll want to read this one!

If there’s one enemy I’ve fought more than a plunging stock after going long, it’s my own brain.

Specifically, that part of my brain that desperately wants to be right. Well, right most times. Okay… maybe every single time and can’t stomach being totally wrong.

Oh you know the feeling!

You enter into a trade, it almost immediately goes against you, and instead of taking a small loss like a disciplined pro, something primal takes over. All sane, logical thoughts get thrown out the window.

This stock has to turn around. I’m sure of it. I know I’m right. Let me just completely remove my stop loss to give it some room to breathe.

And it just keeps going down. Further into the red. The loss just keeps getting bigger and bigger. Your day trade turns into a swing trade. Suddenly that -5% loss you had earlier would have felt like a win if you had just closed it back then. But you didn’t.

You held because your ego couldn’t swallow the fact that you were wrong. You wanted a win and instead face a giant, unrealized loss.

You either die on your sword (blow up your account, get margin called, …) or you swallow your pride, concede defeat, take the big loss and live to trade another day.

But what do you do when the position is finally closed by your own doing or forcefully?

You want to get right back in there and get a win, because that’ll make you feel better.

Suddenly you’re not trading your plan anymore; you’re trading your ego. This can quickly escalate into revenge trading, trying to “make it back” immediately, and a series of increasingly poor decisions. The result? The loss gets even bigger and your inability to get off the charts has only made the pain, and losses, even worse.

It’s a vicious cycle that probably many traders face at some point in their trading “careers”.

Does this sound familiar?

This has been my reality far too many times. I’ve written about the initial humbling lessons I learned in my first month of trading, my reflections after six months of trading, and the last update after trading for 1 year. One common theme that hasn’t gone away has been the battle with my own emotional state and continually doing more damage to my account by trading when under higher levels of emotions.

At one point last year, I decided to act because I was tired of making the same mistakes over and over.

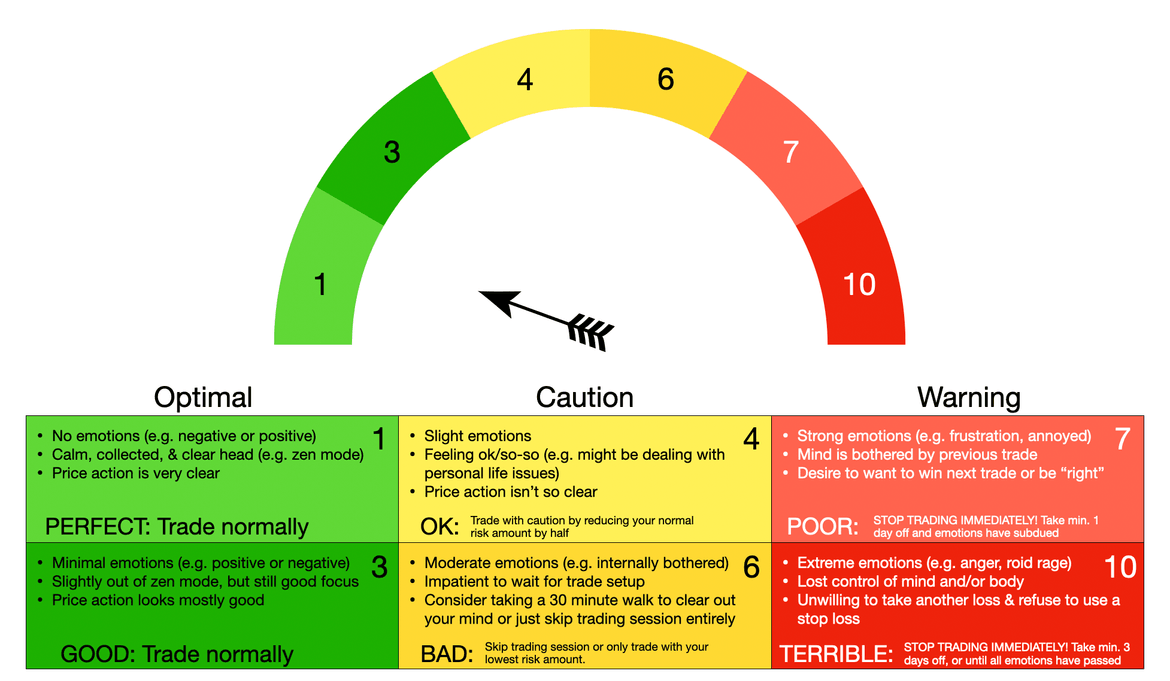

I created a simple chart on Keynote. It was a basic checklist to gauge my emotional level before starting a trading session. Am I calm? Am I anxious? Am I furious about a previous loss or something in my private life? I do admit, I didn’t use it much.

Though it would have saved me twice this year if I had just used it!

But recently, I had one of those heightened emotional state days. Personal matters, but where the emotions come from doesn’t matter. It will result in the same thing if you resort to trading as a fix. This time though, even though I wanted to trade, I decided to stay away. I followed the advice of my chart as I recognized all the warning signs from past events and knew better.

This time, I actually didn’t trade. I mentally ran through my little checklist and realized I was deep in the red zone emotionally. I never opened my broker trading platform. It was a win! I didn’t cause any damage to my account, and that’s exactly what this chart is for: to act as an emotion circuit breaker. To help you reflect before trading to determine when you are not mentally fit for the battlefield of the market.

This emotional state reflection only takes 30s to do, and should be in every traders toolbox.

This recent experience proved how valuable a simple emotion check could be. So, I decided to turn that little chart into a powerful, interactive web tool that anyone can use.

Introducing the Pre-Trading Emotions Checker

I built a free web app to put a structured, repeatable process between your emotions and your trading capital.

You can test out this pre-trading emotions checker tool.

It’s designed to be simple but effective. Here’s what you can do with it:

-

Create Your Emotional Check Rulebook: The tool comes pre-filled with some common emotional states for each level, but you know yourself best. You can click on any text field to personalize the field and define your own specific criteria for each emotional level.

-

Print Out Your Emotional Guardrails: Once you’ve customized your emotion criteria levels to your liking, you can print it out and hang it up on the wall next to your monitor. Having a physical reminder staring you in the face makes it much harder to ignore. They are your emotional level rules and should be followed.

-

Use It On The Go: The mobile version is designed for quick checks. Just ask yourself, “On a scale of 1-10, how are my emotions right now?” Then, tap that number on the visible gauge. The app will immediately show you the relevant emotion card level with the recommended trading actions defined for that state.

This tool isn’t a magic bullet, but it can be a powerful guardrail if used. It forces a moment of self-reflection before you can make any costly mistakes. This tool helps build the discipline to know when you should trade, and more importantly, when to stay away.

All based on your emotional level.

Give it a try and let me know what you think. Building a system to protect yourself from your worst impulses is one of the most profitable trades you can ever make.